ファンダメンタルズとテクニカルどっちを信じればいいんだと、とにかく悩むことが多いですよね。

今回は、Pythonでビットコインのデータを利用し、データフレームを整理確認し、基本的な特徴量を作ろうと思います。Kaggleなどのデータ分析コンペでも最初に行う操作ですのでぜひ覚えましょう。

参考にさせてもらったページは以下のサイトです。

- https://github.com/richmanbtc/mlbot_tutorial

- https://github.com/richmanbtc/crypto_data_fetcher

(テクニカル分析を機械にやってもらえば、人間より高速に完璧にやってくれるのではないかという淡い期待を持ってやっています。)

今回はJupyter notebookを使っています。

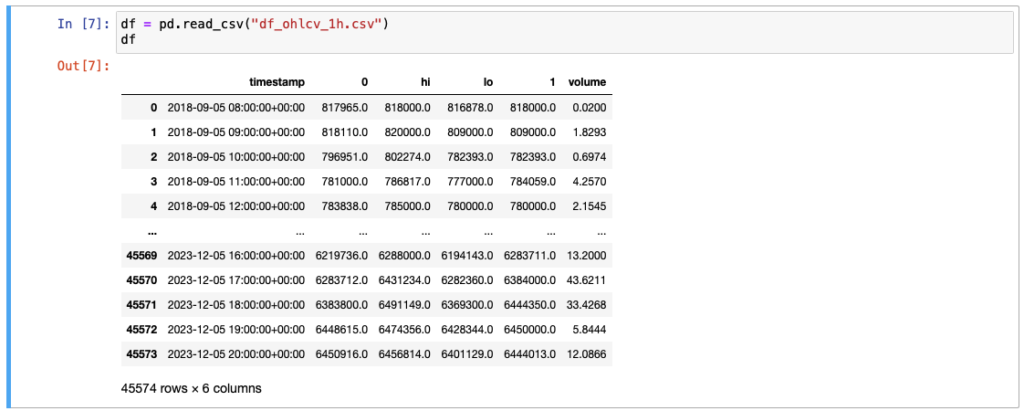

データの読み込み

まずはビットコインの過去の価格データを読み込みます。今回はcsvファイルを用意しておいたので、読み込みます。csvファイルを読み込む時にはpandasの「read_csv」を使います。

import pandas as pd

df = pd.read_csv("df_ohlcv_1h.csv")

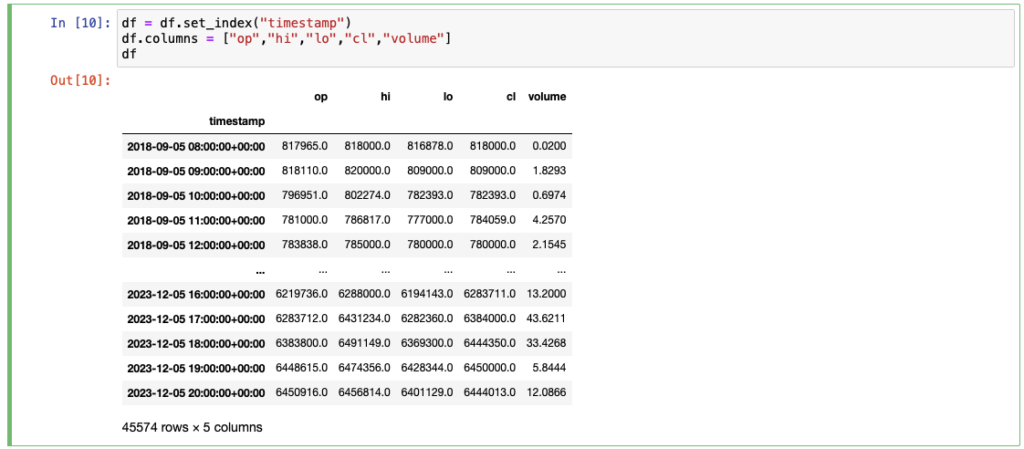

インデックスとカラムの命名

読み込んだデータを見るとインデックスが整数に、カラム名が「1」や「0」になっており、後々見にくくなってくるので、名前を変更しておきます。カラム名は、始値、高値、安値、終値、取引量を英語にしたときの頭文字にしておきます。

# "timestamp"の列をインデックスに設定

df = df.set_index("timestamp")

# カラム名を一括で変更

df.columns = ["op","hi","lo","cl","volume"]

df

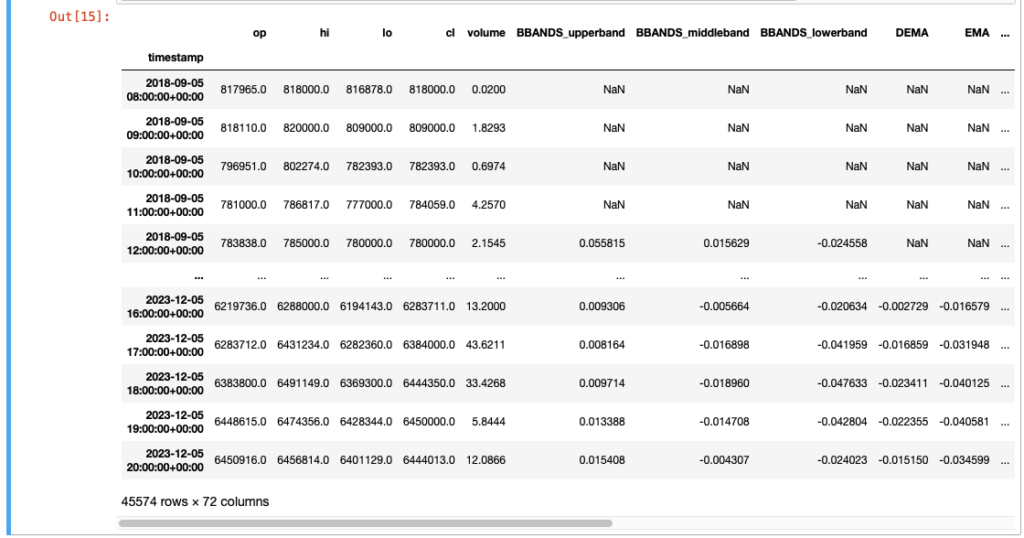

特徴量作成

特徴量を作っていきます。今回はとりあえずいっぱい作っておきます。後で、無い方が良い特徴量を消せばいいので考えられる特徴量を作っておきます。

特徴量を作るときに気をつけるべきポイントは以下の3点です。

- 未来の情報を含めない

- 古すぎる情報も含めない

- 本番環境で取得できない情報を含めない

特徴量は以下のライブラリが便利みたいです。

- TA-Lib

- https://github.com/bukosabino/ta

また価格を見ると2018年9月では約80万円で、2023年12月では約640万円です。機械学習で決定技を使う時には、精度がかなり悪くなってしまうので正規化しておきます。

import talib

def calc_features(df):

open = df['op']

high = df['hi']

low = df['lo']

close = df['cl']

volume = df['volume']

orig_columns = df.columns

hilo = (df['hi'] + df['lo']) / 2

# Bollinger Bands features

df['BBANDS_upperband'], df['BBANDS_middleband'], df['BBANDS_lowerband'] = talib.BBANDS(close, timeperiod=5, nbdevup=2, nbdevdn=2, matype=0)

df['BBANDS_upperband'] = (df['BBANDS_upperband'] - hilo) / close

df['BBANDS_middleband'] = (df['BBANDS_middleband'] - hilo) / close

df['BBANDS_lowerband'] = (df['BBANDS_lowerband'] - hilo) / close

# Double Exponential Moving Average (DEMA) feature

df['DEMA'] = (talib.DEMA(close, timeperiod=30) - hilo) / close

# Exponential Moving Average (EMA) feature

df['EMA'] = (talib.EMA(close, timeperiod=30) - hilo) / close

# Hilbert Transform - Trendline feature

df['HT_TRENDLINE'] = (talib.HT_TRENDLINE(close) - hilo) / close

# Kaufman Adaptive Moving Average (KAMA) feature

df['KAMA'] = (talib.KAMA(close, timeperiod=30) - hilo) / close

# Moving Average (MA) feature

df['MA'] = (talib.MA(close, timeperiod=30, matype=0) - hilo) / close

# Midpoint over period feature

df['MIDPOINT'] = (talib.MIDPOINT(close, timeperiod=14) - hilo) / close

# Simple Moving Average (SMA) feature

df['SMA'] = (talib.SMA(close, timeperiod=30) - hilo) / close

# Triple Exponential Moving Average (T3) feature

df['T3'] = (talib.T3(close, timeperiod=5, vfactor=0) - hilo) / close

# Triple Exponential Moving Average (TEMA) feature

df['TEMA'] = (talib.TEMA(close, timeperiod=30) - hilo) / close

# Triangular Moving Average (TRIMA) feature

df['TRIMA'] = (talib.TRIMA(close, timeperiod=30) - hilo) / close

# Weighted Moving Average (WMA) feature

df['WMA'] = (talib.WMA(close, timeperiod=30) - hilo) / close

# Linear Regression feature

df['LINEARREG'] = (talib.LINEARREG(close, timeperiod=14) - close) / close

# Linear Regression Intercept feature

df['LINEARREG_INTERCEPT'] = (talib.LINEARREG_INTERCEPT(close, timeperiod=14) - close) / close

# Volume-based features

df['AD'] = talib.AD(high, low, close, volume) / close

df['ADOSC'] = talib.ADOSC(high, low, close, volume, fastperiod=3, slowperiod=10) / close

df['APO'] = talib.APO(close, fastperiod=12, slowperiod=26, matype=0) / close

df['HT_PHASOR_inphase'], df['HT_PHASOR_quadrature'] = talib.HT_PHASOR(close)

df['HT_PHASOR_inphase'] /= close

df['HT_PHASOR_quadrature'] /= close

df['LINEARREG_SLOPE'] = talib.LINEARREG_SLOPE(close, timeperiod=14) / close

df['MACD_macd'], df['MACD_macdsignal'], df['MACD_macdhist'] = talib.MACD(close, fastperiod=12, slowperiod=26, signalperiod=9)

df['MACD_macd'] /= close

df['MACD_macdsignal'] /= close

df['MACD_macdhist'] /= close

df['MINUS_DM'] = talib.MINUS_DM(high, low, timeperiod=14) / close

df['MOM'] = talib.MOM(close, timeperiod=10) / close

df['OBV'] = talib.OBV(close, volume) / close

df['PLUS_DM'] = talib.PLUS_DM(high, low, timeperiod=14) / close

df['STDDEV'] = talib.STDDEV(close, timeperiod=5, nbdev=1) / close

df['TRANGE'] = talib.TRANGE(high, low, close) / close

# Trend-based features

df['ADX'] = talib.ADX(high, low, close, timeperiod=14)

df['ADXR'] = talib.ADXR(high, low, close, timeperiod=14)

df['AROON_aroondown'], df['AROON_aroonup'] = talib.AROON(high, low, timeperiod=14)

df['AROONOSC'] = talib.AROONOSC(high, low, timeperiod=14)

df['BOP'] = talib.BOP(open, high, low, close)

df['CCI'] = talib.CCI(high, low, close, timeperiod=14)

df['DX'] = talib.DX(high, low, close, timeperiod=14)

# MFI is Money Flow Index

df['MFI'] = talib.MFI(high, low, close, volume, timeperiod=14)

df['MINUS_DI'] = talib.MINUS_DI(high, low, close, timeperiod=14)

df['PLUS_DI'] = talib.PLUS_DI(high, low, close, timeperiod=14)

df['RSI'] = talib.RSI(close, timeperiod=14)

df['STOCH_slowk'], df['STOCH_slowd'] = talib.STOCH(high, low, close, fastk_period=5, slowk_period=3, slowk_matype=0, slowd_period=3, slowd_matype=0)

df['STOCHF_fastk'], df['STOCHF_fastd'] = talib.STOCHF(high, low, close, fastk_period=5, fastd_period=3, fastd_matype=0)

df['STOCHRSI_fastk'], df['STOCHRSI_fastd'] = talib.STOCHRSI(close, timeperiod=14, fastk_period=5, fastd_period=3, fastd_matype=0)

df['TRIX'] = talib.TRIX(close, timeperiod=30)

df['ULTOSC'] = talib.ULTOSC(high, low, close, timeperiod1=7, timeperiod2=14, timeperiod3=28)

df['WILLR'] = talib.WILLR(high, low, close, timeperiod=14)

# Average True Range (ATR) feature

df['ATR'] = talib.ATR(high, low, close, timeperiod=14)

# Normalized Average True Range (NATR) feature

df['NATR'] = talib.NATR(high, low, close, timeperiod=14)

# Hilbert Transform - Dominant Cycle Period feature

df['HT_DCPERIOD'] = talib.HT_DCPERIOD(close)

# Hilbert Transform - Dominant Cycle Phase feature

df['HT_DCPHASE'] = talib.HT_DCPHASE(close)

# Hilbert Transform - Sine and Leadsine features

df['HT_SINE_sine'], df['HT_SINE_leadsine'] = talib.HT_SINE(close)

# Hilbert Transform - Trend Mode feature

df['HT_TRENDMODE'] = talib.HT_TRENDMODE(close)

# Beta feature

df['BETA'] = talib.BETA(high, low, timeperiod=5)

# Pearson correlation coefficient feature

df['CORREL'] = talib.CORREL(high, low, timeperiod=30)

# Linear Regression Angle feature

df['LINEARREG_ANGLE'] = talib.LINEARREG_ANGLE(close, timeperiod=14)

# Creating Normalized lag variables

for i in range(5):

df["LAG_" + str(i + 1)] = df["cl"].shift(i) / df["cl"].shift(i + 1)

return df

df = calc_features(df)

df

まとめ

今回はカラムとインデックスの整理、特徴量を作成する方法を紹介しました。

ビットコインの価格変動は、ランダムウォークですが、分析することによって未来の価格が分かるかもしれません。それが分かれば、儲けることができるかもしれません。夢かもしれません。

続きも書いていこうと思ってます。

コメント